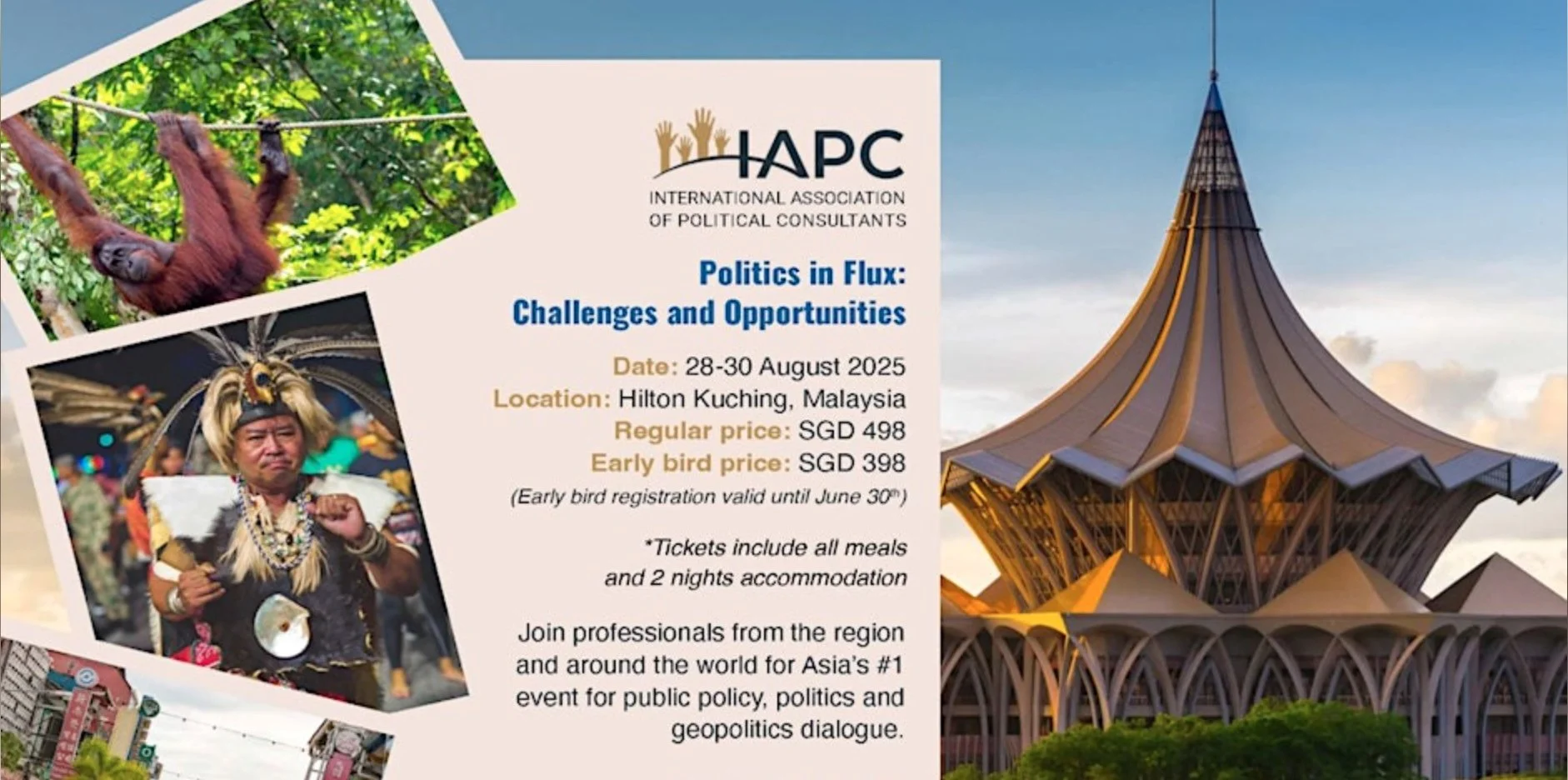

Navigating Geopolitical Currents: Insights from the IAPC Kuching Meeting 2025

As Adviser to The Aroca Group (also a client of Thoth Impact Advisory), I had the privilege of participating in the International Association of Political Consultants (IAPC) Kuching Meeting 2025 in Malaysia, held from 28th to 30th August specifically at the Hilton Kuching, Kuching, the capital of the State of Sarawak in the Malaysia’s segment of the Island of Borneo. This regional gathering brought together over 60 public affairs professionals from across the Asia-Pacific region and beyond, providing a timely forum for examining the complex geopolitical dynamics that increasingly shape our work in impact investing, public policy and ESG advisory.

The conference's central theme—"ASEAN's expanding role amid intensifying geopolitical and trade tensions"—could not have been more pertinent for practitioners operating at the intersection of policy, finance, and sustainable development. As we navigate an era of heightened uncertainty, understanding these macro-political currents becomes essential for creating meaningful shared value through strategic ESG interventions.

At the group photo of all participants of the IAPC Kuching Meeting 2025 at the Hilton Kuching.

ASEAN at the Geopolitical Crossroads

The opening discussions examined ASEAN's evolving geopolitical position as regional tensions intensify and traditional alliances are tested. The conversations highlighted how the bloc's historically neutral stance is being recalibrated to meet contemporary challenges, particularly as member states navigate competing economic and security interests between major powers.

For impact investors, public policy professionals and ESG practitioners, this regional repositioning presents both opportunities and complexities. ASEAN's enhance role as a mediating force offers potential for ESG-focused investments that can weather political volatility whilst delivering measurable social and environmental returns. The growing importance of the region as a stabilising presence creates fertile ground for sustainable development financing that aligns with broader geopolitical stability objectives.

The New Asian Order: Regional Power Dynamics

Particularly compelling were the sessions examining how major regional powers are reshaping investment flows and development partnerships across Asia-Pacific. The discussions explored how different approaches to infrastructure investment and social development are creating new paradigms for international cooperation and competition.

Drawing from my experience in development economics and collaboration with multilateral institutions, I found these conversations directly relevant to understanding how traditional Western development finance models are evolving. The implications for impact investing are profound, as practitioners must navigate diverse approaches to infrastructure and social investment whilst maintaining adherence to robust ESG principles and public policy governance frameworks.

Business Engagement in Political Processes

The conference addressed a critical contemporary question: the appropriate level of business involvement in political processes. Sessions explored how private sector engagement with political systems can advance sustainability agendas whilst managing inherent reputational and operational risks.

This resonates strongly with current Impact Investment, Public Policy and ESG consultancy practice, Thoth Impact Advisory, where corporate political engagement—when conducted transparently and strategically—can amplify the impact of sustainable investments. However, as the discussions made clear, this requires sophisticated understanding of local political contexts, stakeholder dynamics, and the complex interplay between commercial interests and democratic governance.

Skills for Uncertain Times

A practical focus emerged around essential competencies for navigating turbulent political environments. The emphasis on adaptability, cross-cultural competency, and systems thinking aligns directly with our approach at Thoth Impact Advisory, where we must constantly navigate the intersection of public policy, private investment, and social impact.

The conference's election analyses covering Australia, Canada, and Singapore provided insights into how democratic processes are adapting to populist pressures and technological disruption. These political trends have direct implications for ESG regulation, alongside impact investing and public policy governance frameworks across the region, influencing everything from carbon pricing mechanisms to social impact measurement standards.

Cultural Context and Community Engagement

Beyond the formal sessions, the conference included meaningful cultural elements that reinforced the importance of local context in development work. The visit to the Sarawak Biodiversity Centre and Semenggoh Wildlife Centre provided participants with direct exposure to conservation efforts and community empowerment initiatives.

Me diagonally behind from the left of the indigenous Dayak warrior for the group photo at the Sarawak Biodiversity Centre right after the the warrior ceremony.

Particularly notable was witnessing an Indigenous Dayak warrior ceremony, which exemplified the Centre's commitment to documenting and celebrating Sarawak's rich ethnic heritage. The Centre's Traditional Knowledge Documentation Programme represents exactly the kind of initiative that demonstrates how authentic development must be grounded in respect for Indigenous knowledge systems and community leadership.

Ozan Ibrism (on the right), Managing Director of The Aroca Group, partaking in an indigenous Dayak warrior ceremony at the Sarawak Biodiversity Centre.

This cultural immersion reinforced a fundamental principle of impact investing: sustainable development outcomes require deep appreciation for local contexts, traditions, and community priorities. The Centre's work in empowering Indigenous Dayak peoples through biodiversity knowledge preservation and benefit-sharing arrangements exemplifies how environmental conservation and social justice can be mutually reinforcing when approached with cultural sensitivity and community partnership.

The visit also included the opportunity to observe orangutans in their protected rehabilitation habitat, reinforcing the interdependence of ecological stewardship and sustainable development. Informal exchanges with local communities further revealed the depth of Sarawak’s living heritage, affirming that genuine development work must be grounded in respect for local cultures and environments.

The orangutans at Semenggoh Wildlife Centre were delightful to observe.

Professional Networks and Collaborative Impact

The networking opportunities proved invaluable, connecting professionals from diverse backgrounds who share commitments to democratic processes and effective governance. These connections will undoubtedly contribute to future collaborative initiatives that bridge the gap between political strategy and impact measurement—areas where expertise in development economics, public policy, impact investing and ESG consulting can contribute meaningfully to regional dialogue.

The conference reinforced my conviction that meaningful progress in addressing regional challenges requires creating shared value—ensuring that solutions serve multiple stakeholders whilst advancing democratic governance and sustainable development objectives. This principle, foundational to Thoth Impact Advisory's practice, becomes even more critical as geopolitical tensions create new complexities for regional cooperation.

Hanging out with an indigenous Dayak warrior at one of the evening functions at the conference.

Looking Forward: Implications for Impact Practice

The IAPC Kuching Meeting 2025 underscored the vital role that political risk assessment plays in contemporary impact investing, public policy and ESG advisory. As ASEAN continues positioning itself strategically amid global uncertainties, forums like this provide essential platforms for sharing best practices and developing innovative approaches to governance challenges.

One the rooftop of Fort Magherita, where the English Brooke dynasty, i.e. “The White Rajahs” ruled Sarawak as an autonomous within the British Empire, from the late 19th to mid 20th Centuries. The Sarawak State Legislative Assembly is in the background.

The insights gained will inform my ongoing work with both The Aroca Group and Thoth Impact Advisory, particularly in developing ESG frameworks that account for political risk whilst supporting governance institutions and sustainable development outcomes across the Asia-Pacific region. The conference's emphasis on adaptability and cross-cultural competency aligns directly with our approach to creating financial solutions that accommodate regional complexity whilst maintaining rigorous impact measurement standards.

Standing on the lawn, with cannons, at another section of Fort Margharita, with Kuching’s CBD in the background.

As practitioners working at the nexus of finance, policy, and social impact, understanding these geopolitical currents becomes essential for designing interventions that can deliver authentic shared value in an increasingly uncertain world. The conversations in Kuching have reinforced that effective impact investing requires, not just financial acumen and ESG expertise, yet also sophisticated political risk assessment and deep appreciation for the cultural contexts that ultimately determine whether development initiatives create lasting positive change.

The path forward requires continued engagement with forums like this, where the intersection of political strategy and impact measurement can be explored with the nuance and sophistication that our complex regional environment demands.